You can also issue a debit memorandum for additional services that you’re required to perform.

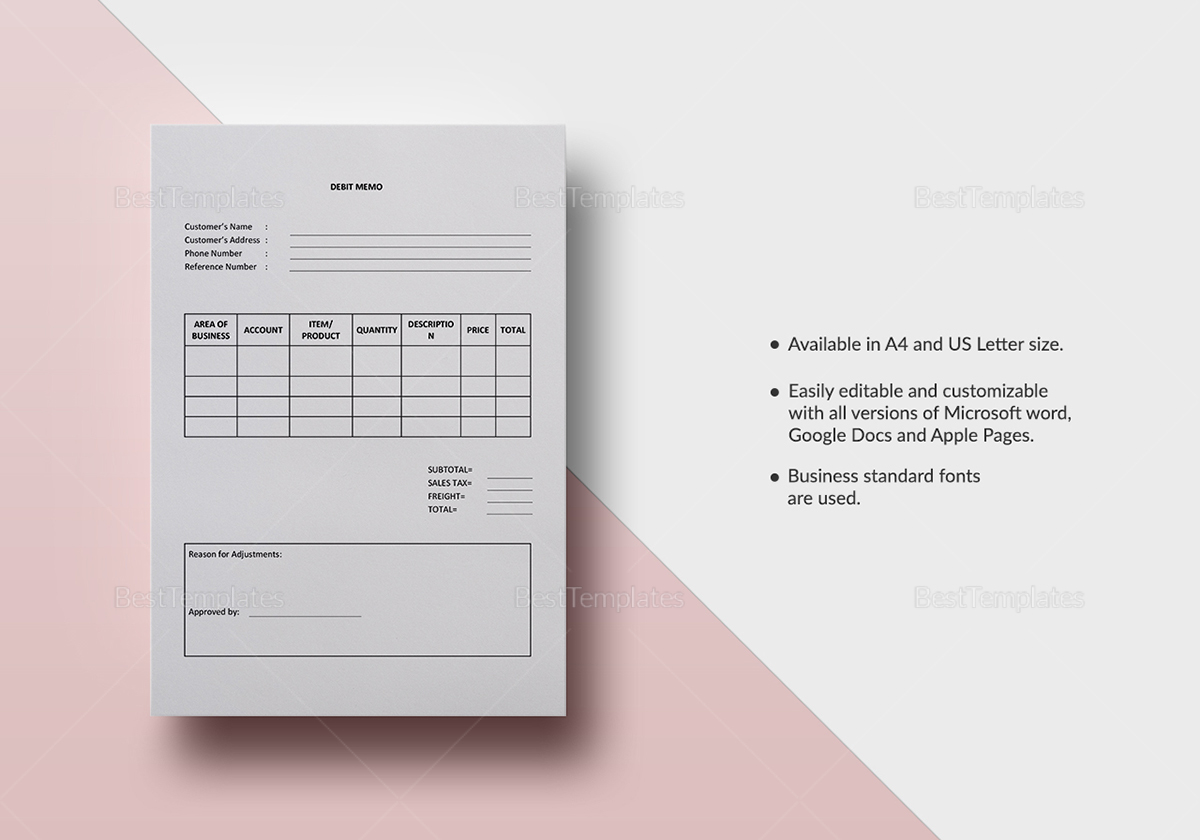

Incremental billing: If you feel that you have undercharged your client for an item or a service, you can issue a debit note for the additional charges.It’s better to use a debit note only when the residual balance is the result of an accounting error You can issue a credit memo, in this case, to offset the positive outstanding balance although some businesses prefer to make a refund. Internal offset: At times, customers may end up making an overpayment.When Do You Issue A Debit Memo?ĭebit notes can be issued both from a buyer or a service provider.īuyers issue a debit note when they receive items with defects, purchases/services they’re not satisfied with, or when an item doesn’t match the original order.Īs a business owner, you might be required to issue a debit note in the following cases: Make sure to reference the original invoice when issuing a memo. Invoice number and invoice date (lists details of the invoice against which you’re issuing the memo).Description of items/services (quantity, price-per-item, total price, taxable value, and so on).Tax information about your company as well as your client’s.The name of your company along with the contact details (phone, address, and so forth).Customer’s name and contact details (phone number, address, fax, and so on).The information that goes on a debit memo or debit note is similar to that which goes on an invoice. What Information Does A Debit Memo Contain? A memo resolves these through an internal offset, incremental billing, or bank transactions. Generally, debit memorandums are issued for reasons relating to bank fees, under-billing invoices, or adjusting accidental positive balances in the customer’s account. Moreover, you’ll be required to leave a record of any memos on your monthly statement of the accounts receivables. For example, if your client asks for additional services that weren’t part of the original agreement, you can either issue a new invoice or use a debit note. It’s the opposite of a credit memorandum where the latter is used to reduce or write off an over-billed invoice.Īt times when businesses are required to increase the billed amount, they choose to release a new invoice.

This memo is a legal document that informs the customer of a debit adjustment made to their accounts. What Is A Debit Memo & For What Is It Used For? This is where a debit memo comes into play. In such a case, the service provider will have to make a billing adjustment.

Freelance project workers often realize they’ve undercharged their services when compared with the amount of time and energy expended. Unfortunately, this is something many freelancers are familiar with. The act of undercharging is quite common in businesses.

0 kommentar(er)

0 kommentar(er)